A feature-rich trading application optimized for global,

around the clock multi-asset automated trading

Algorithmic Trading Software designed from the perspective of a quantitative trader

Features

Automated trading, especially if it takes place on a variety of exchanges across the world, imposes requirements on the trading software. At Mercurius, we recognized the specific needs of algorithmic or data-driven automated trading. We have developed tools and concepts previously not known to the trading community in order to facilitate the complex business of automated trading in various asset classes.

We believe that trading supervision is there only to address exceptional circumstances. All business-as-usual events (like exchange holidays) should be taken care of by your trading platform, regardless of instrument, jurisdiction and day or time of trading.

An in-memory design approach together with an in-house developed wire format enables spectacular performance and throughput. Don't be afraid to add a few symbols to trade on; Mercurius is more than prepared.

To facilitate auction trading, we have developed a time and activity based proprietary market model helping to place orders at the most convenient time during auctions.

To anticipate whether markets of interest are open and at what time you can start trading them, we developed an ecosystem of Exchange Calendars, Trading Hours and Time Zones. Never miss a daylight saving time change in any jurisdiction again, instead trade with confidence.

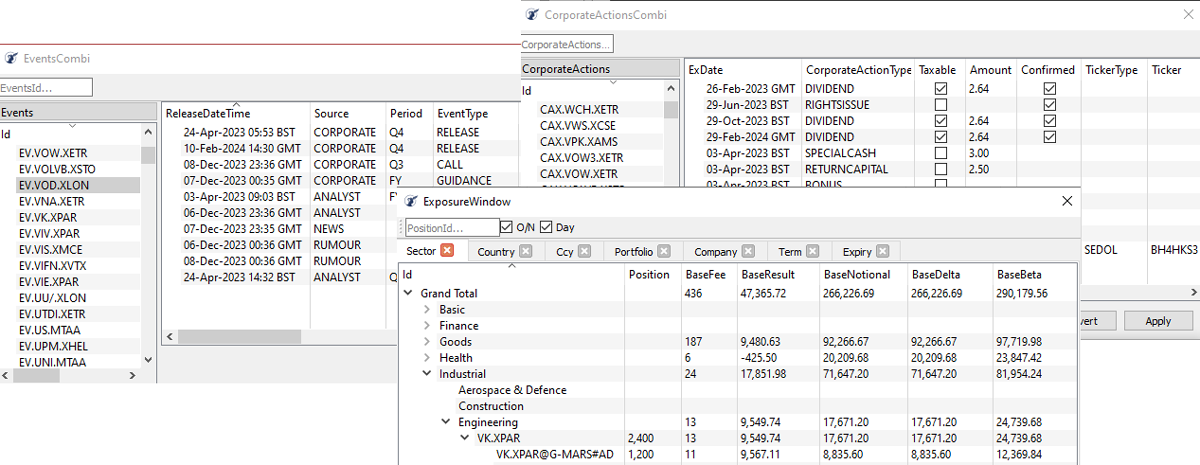

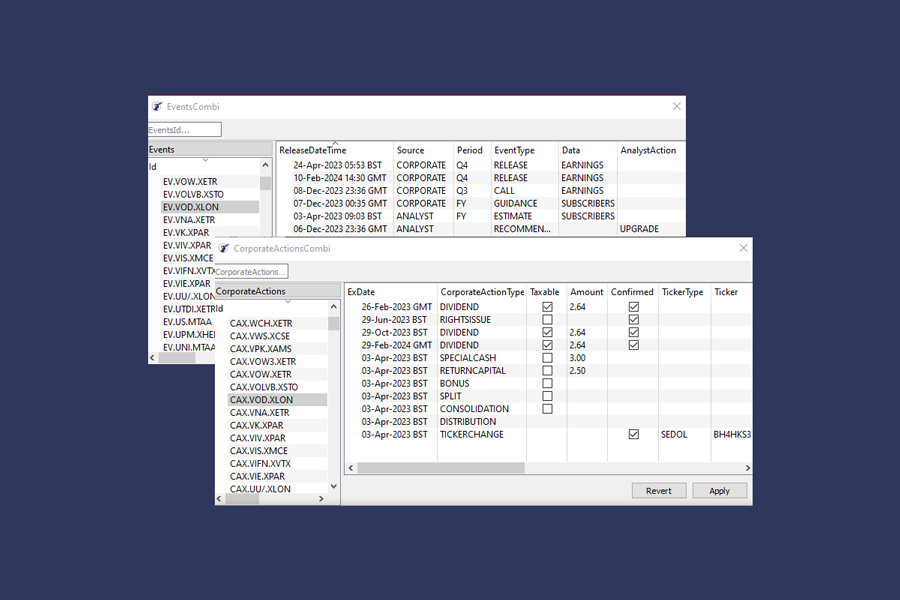

Events and Corporate Actions generally influence price discovery of securities and derivatives. Mercurius supports virtually all types of Events and Corporate Actions, ready to embed them in the client's business logic with a single line of code.

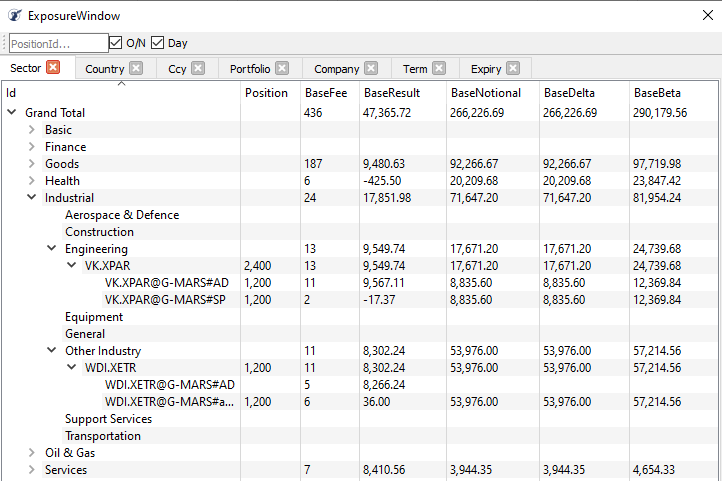

Aggregating exposure measures across asset classes and currencies requires additional measures. While currencies can be compared using a so-called base currency, greeks are a different story. To aggregate and to compare greeks, Mercurius developed proprietary tools specific for this purpose. In the end, gamma in the Topix Index is quite difficult to compare to gamma in Vodafone stock.

Trader

Your business is trading and Mercurius appreciates that the trader's perspective should be leading in the design of the trading platform, without losing sight of the other roles. Mercurius supports trading activities ranging from high touch to low touch and everything in between. Customizing your workspace is obvious.

Developer

Your automated trading starts with the implementation of your trading rules or business logic. At Mercurius, we believe that the developer should experience no constraints to what logic can be implemented, no matter how complex. If it can be coded, Mercurius can handle it.

Risk Management

Trading introduces risk, as simple as that. Successful trading depends more often than not on proper risk management. Mercurius recognized that risk management should be an integral part of trading and therefore we incorporated sophisticated risk management tools in our trading platform.

Backoffice

It doesn't stop with the trade, for middle and back office the joy only begins after the trade. Wide-spread automated trading generally results in a high number of trades, all of them with a need to be reconciled against counterparty or broker statements.

"Designed from the perspective of a quantitative trader, executing a variety of trading strategies on exchanges across the globe with minimal interference."

Interested to experience the look and feel of Mercurius? Simply download and install our UI to connect to an already established fully functional platform with data, orders, trades, algos and more.