It doesn't stop with the trade, for middle and back office the joy only begins after the trade. Wide-spread automated trading generally results in a high number of trades, all of them with a need to be reconciled against counterparty or broker statements.

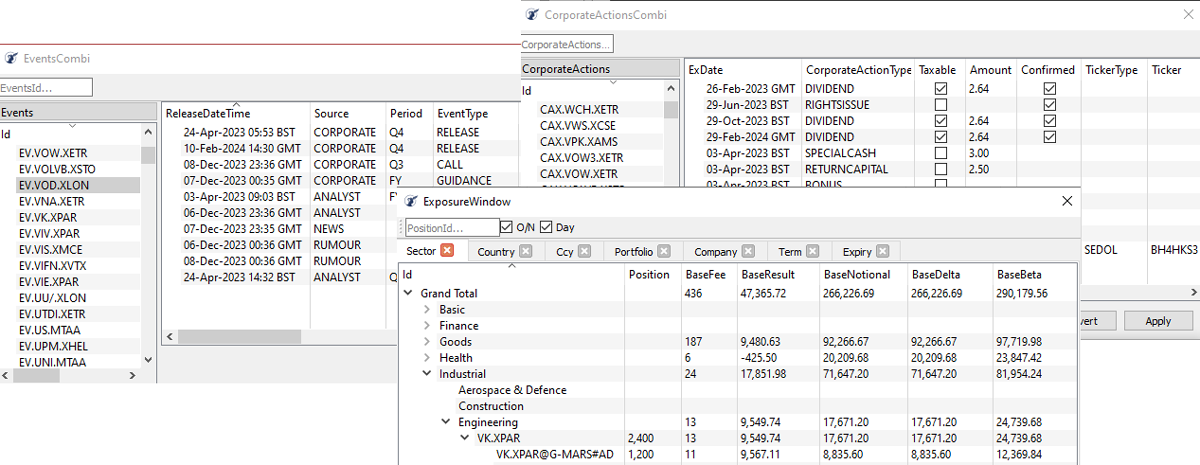

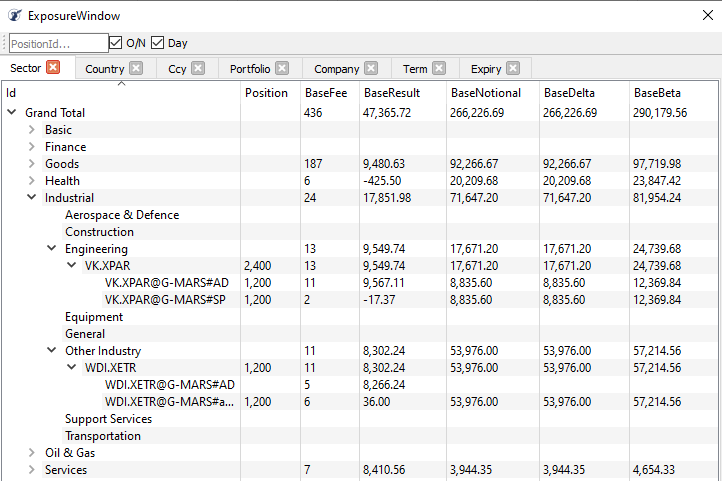

Mercurius calculates trading fees using versatile fee schedules capable of coding virtually any fee rule in existence. Trades can be assigned multiple fees in any currency, like broker fees, exchange fees, regulatory fees et cetera.

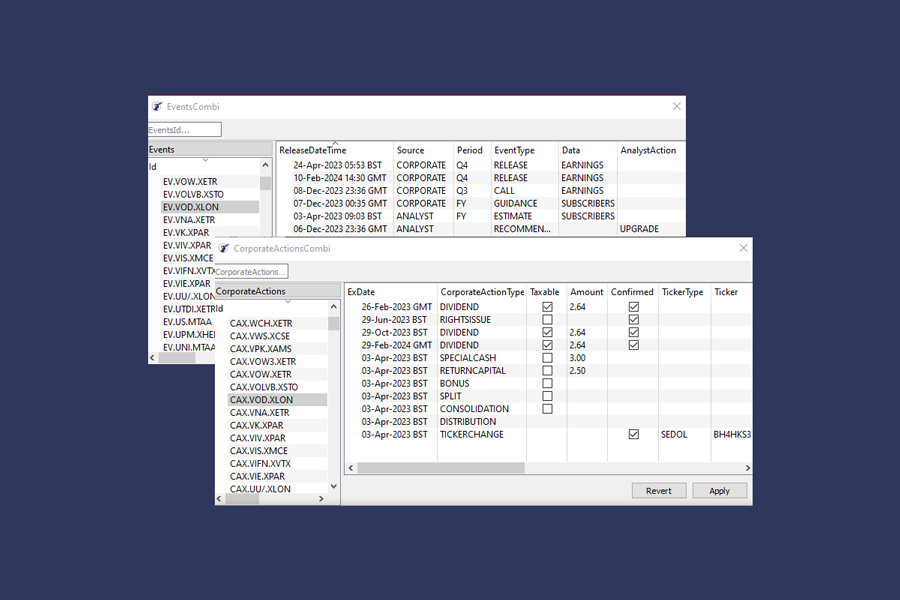

Diversified portfolios tend to generate a lot of individual cash flows out of corporate actions like dividends under different tax regimes. To help reconciling, Mercurius automatically generates these cash flows based on positions in custody and domicile specific rules on withholding tax.

Mercurius develops a tool to automate the reconciliation process based on customizable inputs. To comply with regulatory reporting duties, Mercurius develops functionality to automatically generate such reports based on daily trading activity and positions in custody.